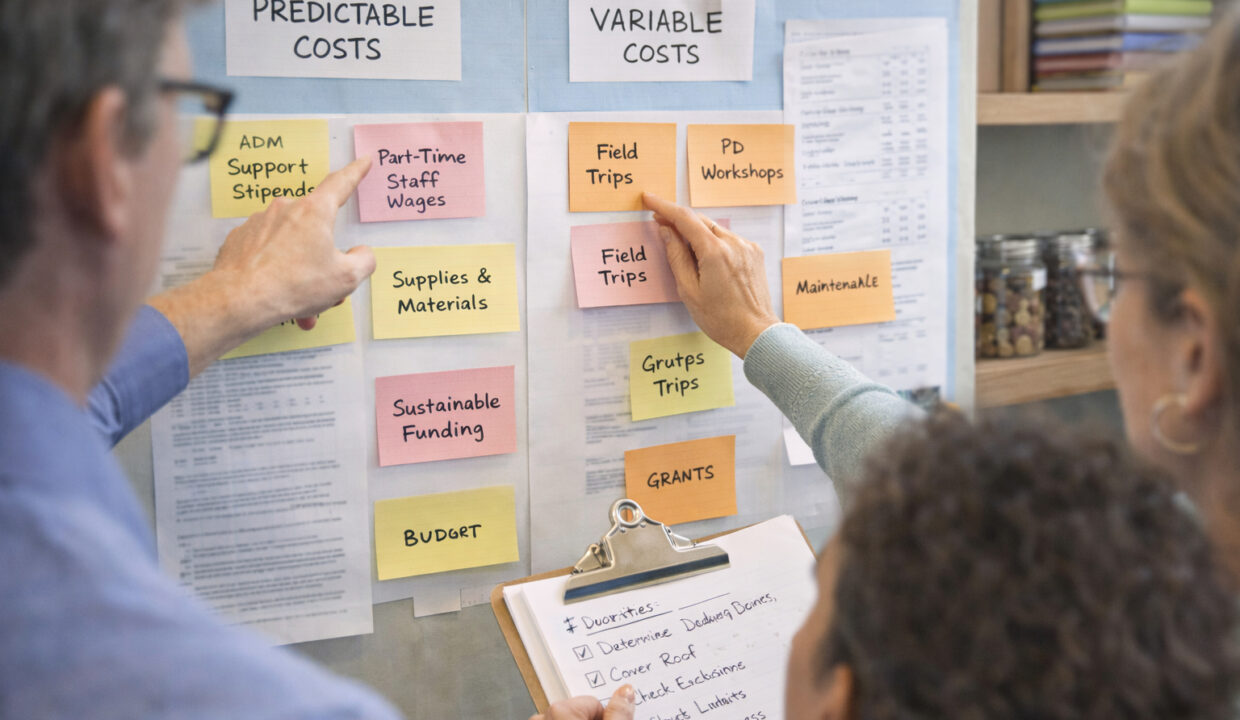

Understanding and organizing education expenses is essential for families and institutions that want stable financial progress. Clear forecasting and simple systems make cost management less stressful and more effective. By separating predictable costs from variable ones, planners can reduce surprises and focus resources where they matter most. This article outlines practical steps to assess costs, reduce unnecessary spending, and plan for long-term affordability.

Assessing Current and Future Education Costs

Begin with a thorough inventory of current spending on tuition, materials, technology, and support services. Include recurring monthly or yearly fees and one-time items such as testing or specialized equipment to capture the full picture. Project future needs by considering program length, inflationary factors, and likely changes in course or resource requirements. Use simple spreadsheets or budgeting tools to model different scenarios and identify which costs are most sensitive to change.

Regular reviews help keep projections accurate as circumstances evolve. Set quarterly or semester checkpoints to update estimates and adjust plans as needed.

Practical Cost-Reduction Tactics

Identify areas where quality can be maintained while spending is reduced, such as open educational resources, shared subscriptions, or refurbished hardware. Negotiate group discounts for classroom supplies or software and consider bulk purchasing with peer institutions or family networks. Prioritize spending on high-impact items that directly support learning outcomes and postpone or phase lower-impact purchases. Encourage digital-first resources where appropriate to reduce recurring print and shipping costs.

- Evaluate subscriptions annually to eliminate underused services.

- Explore open-source or low-cost alternatives to commercial tools.

- Coordinate equipment sharing across departments or cohorts.

These tactics typically require modest initial effort but can yield substantial savings over a multi-year horizon.

Planning for Long-Term Affordability

Long-term planning combines savings strategies, predictable funding sources, and contingency reserves to guard against unexpected expenses. Establish an education fund or dedicated account to smooth payments and reduce reliance on credit. Align savings goals with key milestones such as enrollment periods and major purchases, and consider automated transfers to maintain consistency. Scenario planning—best case, expected case, and stress case—helps stakeholders prepare for different financial realities.

Building flexible plans with clear priorities makes reallocating resources less disruptive when needs change.

Conclusion

Managing education costs effectively starts with accurate assessment and continues through targeted reductions and disciplined saving. Regular monitoring and simple tools help maintain control without sacrificing learning quality. With consistent planning, education expenses become predictable and manageable for the long term.